|

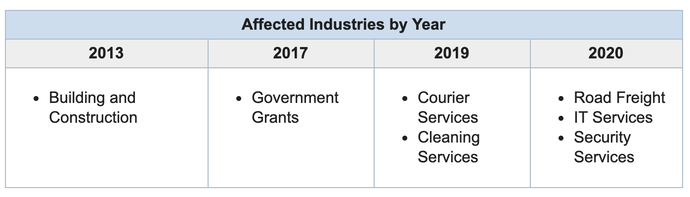

The TPAR informs the ATO about payments that are made to contractors for providing services. Industries required to report TPAR for 2019 are listed in the below table. Contractors can include subcontractors, consultants and independent contractors. They can be operating as sole traders (individuals), companies, partnerships or trusts. The ATO uses this information to identify contractors who haven't met their tax obligations. The Taxable Payments Annual Reporting scheme for contractors applies to the industries as per below: What Has to be Reported?

A TPAR report requires the business to outline:

ICB feels that most of this information is already captured in the day-to-day bookkeeping processes in the accounting file. It may just mean that clients/bookkeepers need to be more diligent in capturing ABNs for suppliers and flagging those suppliers or employees (if a voluntary agreement is in place) that are reportable and assigning the payments into a separate account on the chart of accounts. Who Can Report? Tax Agents and BAS Agents can advise, prepare, and lodge the Taxable Payments Annual Report. Business owners can also prepare and lodge the report. The bookkeeper can assist the owner to prepare the report but may not lodge the report directly. Reconcile TPAR to Subcontractor's Expense Account Recommend comparing the total value of subcontractor’s expense to the TPAR report. You may find a small difference which may be a result of

Prepare and Lodge TPAR The form must be lodged either electronically or via the ATO paper form.To lodge the Taxable Payments Annual Report using electronic transfer, you need to create an electronic annual report data file using accounting software. Note: You cannot lodge the following media forms: spreadsheets, CD ROM, DVD, USB, floppy or zip disk. Electronic Lodgement Options

TPAR Lodgement Due Date TPAR lodgement date is 28 August each year. Paper FormIf you want to lodge a paper form, you must complete and send the Taxable Payments Annual Report to the ATO. Note: You must use this form; you cannot create your own form. TPAR – Nil Report For the 2019 lodgement year you are required to lodge Nil report if in:

If you need to amend a Taxable Payments Annual Report, please contact us to assist you in the process.

0 Comments

Leave a Reply. |

Archives

February 2023

Categories

All

|

RSS Feed

RSS Feed