As announced on 22 March, the government is providing up to $100,000 to eligible small and medium sized businesses and not-for-profits (including charities) that employ people, with a minimum payment of $20,000. These payments will help business and not-for-profit cash flow so they can keep operating, pay their bills and retain staff. Small and medium sized business entities with aggregated annual turnover under $50 million and that employ workers are eligible. Not-for-profit entities (NFPs), including charities, with aggregated annual turnover under $50 million and that employ workers will now also be eligible. This will support employment activities at a time where NFPs are facing increasing demand for services. Under the enhanced scheme, employers will receive a payment equal to 100% of their salary and wages withheld (up from 50%), with a:

Eligible entities will receive an additional payment equal to the total of all the Boosting Cash Flow for Employers payments they have received. This means that eligible entities will receive at least $20,000, up to a total of $100,000 under both payments. This additional payment continues cash flow support over a longer period:

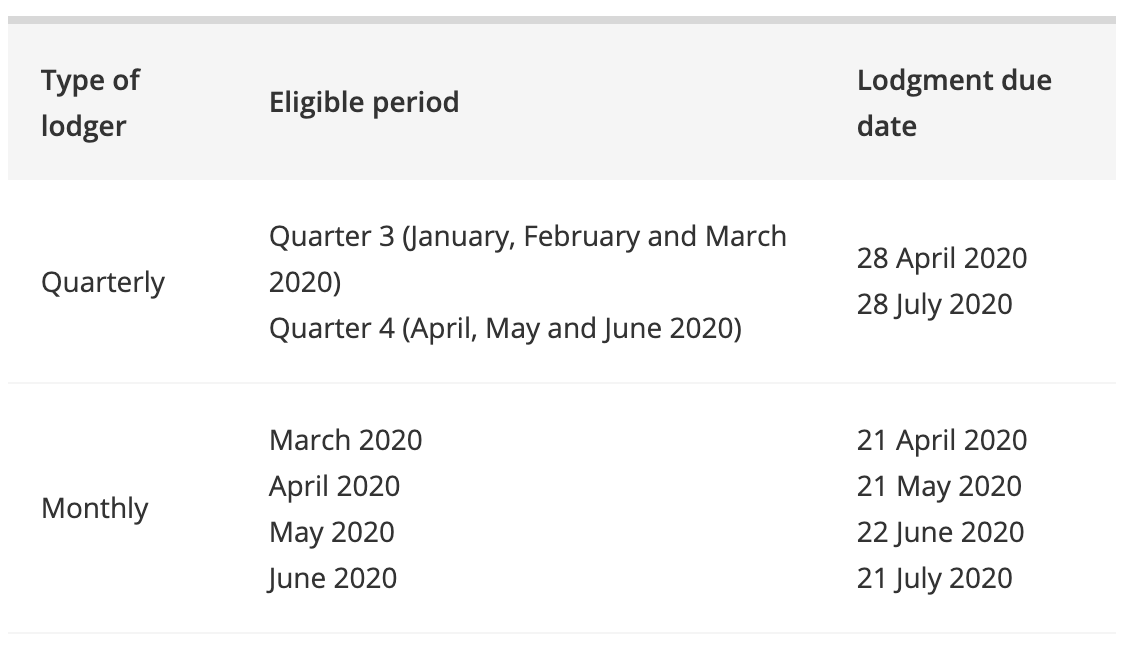

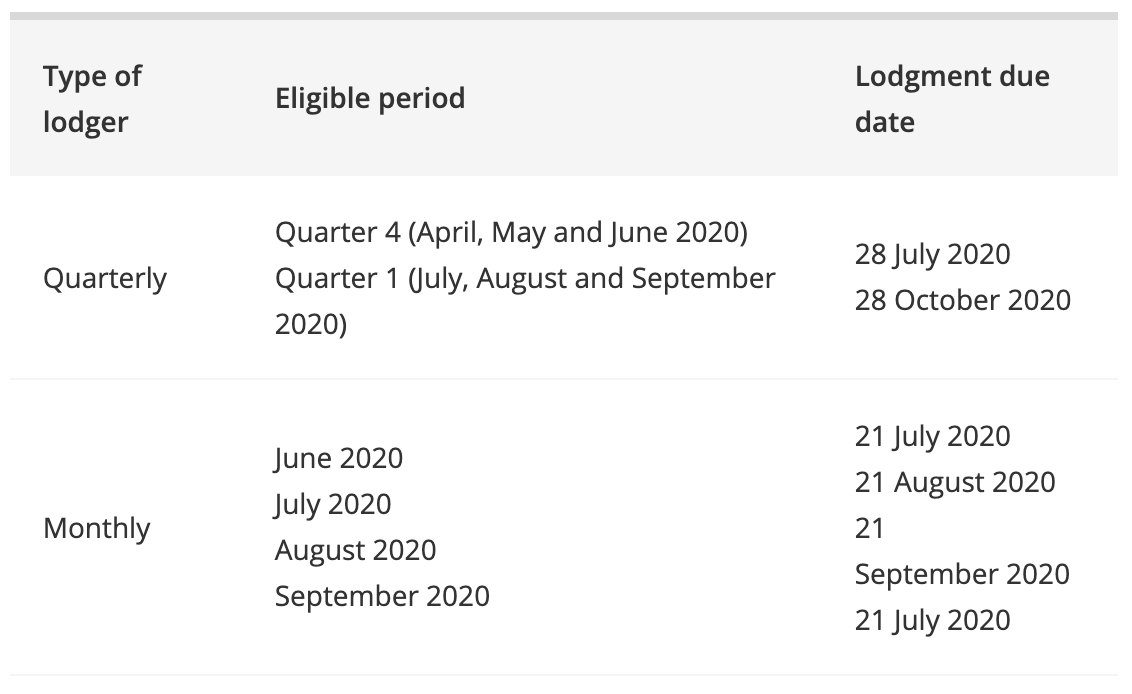

The cash flow boost provides a tax-free payment to employers. We will automatically calculate it. Eligibility for Boosting Cash Flow for Employers payments Small and medium sized business entities and NFPs with aggregated annual turnover under $50 million and that employ workers will be eligible. Eligibility will generally be based on prior year turnover. We will deliver the payment as an automatic credit in the activity statement system from 28 April 2020 upon employers lodging eligible upcoming activity statements. Eligible employers that withhold tax to the ATO on their employees’ salary and wages will receive a payment equal to 100% of the amount withheld, up to a maximum payment of $50,000. Eligible employers that pay salary and wages will receive a minimum payment of $10,000, even if they are not required to withhold tax. The payments will only be available to active eligible employers established before 12 March 2020. However, charities that are registered with the Australian Charities and Not-for-profits Commission will be eligible regardless of when they were registered, subject to meeting other eligibility requirements. This recognises that new charities may be established in response to COVID-19. Eligibility for additional payment To qualify for the additional payment, the entity must continue to be active. Monthly activity statement lodgers For monthly activity statement lodgers, the additional payments will be delivered as an automatic credit in the activity statement system. This will be equal to a quarter of their total initial Boosting Cash Flow for Employers payment following the lodgment of their June 2020, July 2020, August 2020 and September 2020 activity statements (up to a total of $50,000). Quarterly activity statement lodgers For quarterly activity statement lodgers the additional payments will be delivered as an automatic credit in the activity statement system. This will be equal to half of their total initial Boosting Cash Flow for Employers payment following the lodgment of their June 2020 and September 2020 activity statements (up to a total of $50,000). Timing of Boosting Cash Flow for Employers payments The Boosting Cash Flow for Employers payment will be applied to a limited number of activity statement lodgments. We will deliver the payment as a credit to the entity upon lodgment of their activity statements. If this places the entity in a refund position, we will deliver the refund within 14 days. Quarterly & Monthly lodgers Quarterly lodgers will be eligible to receive the first payments for the quarters ending March 2020 and June 2020. Monthly lodgers will be eligible to receive the first payments for the March 2020, April 2020, May 2020 and June 2020 lodgments. To provide a similar treatment to quarterly lodgers, the payment for monthly lodgers will be calculated at three times the rate (300%) in the March 2020 activity statement. The minimum payment will be applied to the entities’ first lodgment. Timing of additional payment The additional payment will be applied to a limited number of activity statement lodgments. We will deliver the payment as a credit to the entity upon lodgment of their activity statements. If this places the entity in a refund position, we will deliver the refund within 14 days. Quarterly lodgers will be eligible to receive the additional payment for the quarters ending June 2020 and September 2020. Each additional payment will be equal to half of their total initial Boosting Cash Flow for Employers payment (up to a total of $50,000).

Monthly lodgers will be eligible to receive the additional payment for the June 2020, July 2020, August 2020 and September 2020 lodgments. Each additional payment will be equal to a quarter of their total initial Boosting Cash Flow for Employers payment (up to a total of $50,000). Please note that if you have a debt with the ATO, either for BAS or for Income tax, the ATO will transfer the incentive amount to those debt accounts first and then send you the residual, if applicable, 14 days after processing. Also, while this amount appears to not have to be paid back in full, the ATO may reduce the expenses on your next Income Tax return by the amount of the payment, so that you pay a bit more tax, but it remains to be seen how that will go. Please keep in mind that we will process your BAS returns as soon as we have ALL relevant information to hand, so please start to get your information together NOW. Thank you for your support in this very trying time, we will certainly be working very hard in the next week to get as up to date as we can to ensure smooth and efficient workflow for BAS lodgement for our valued clients. Many Thanks Sally

0 Comments

|

Archives

February 2023

Categories

All

|

||||||

RSS Feed

RSS Feed