|

Superannuation

Compliance New legislation to amend laws relating to Super and PAYG withholding compliance have become effective from 1st April 2019:

Employment Termination Payment Cap (ETP) Employment termination payment (ETP) is a lump sum payment rather than a wage payment made as a result of termination. From 1st July 2019 the ETP cap threshold for taxing the lump sum payment for both life and death benefits will increase to $210,000 and the Whole of income cap remains at $180,000 Redundancy Threshold (Lump Sum D) From 1st July 2019 redundancy tax free threshold Increases to $10,638 + $5,320 for each year of service Tax Rates PAYG Withholding Tables Legislation for changes to income tax thresholds including following offsets:

New low- and middle-income tax offsets apply for 2018–19 through and including years to 2021–2022 Australian resident employees (and certain trustees) that do not exceed a taxable income of $125,333 are entitled to the new low and middle tax offset. This is in addition to the existing low-income tax offset. It is calculated during the preparation of an income tax return. Calculated as follows. If taxable income:

A new set of repayment thresholds for 2019/2020 From 1 July 2019, the new minimum HELP repayment threshold will be when taxable income is $45,881 or above, with a 1% repayment rate, with a further 17 thresholds and repayment rates, up to a top threshold of $134,573 at which 10% of income is repayable. Source: Department of Education and Training

New South Wales payroll tax threshold to increase on 01 July 2019 to $900,000 annually.

The current motor vehicle GST limit is $57,581 (GST $5,234). No changes advised at this time. Living Away from Home Allowance (LAFHA) 2020 Living Away from Home Allowance (LAFHA) is an allowance to compensate an employee who is required to live away from their usual place of residence to do their job. This allowance compensates their additional non-deductible expenses. The LAFHA allowance will increase for 2019/2020 financial year for reasonable food and drink within Australia. Children are those aged under 12 at the beginning of the year. Australian and Overseas LAFHA figures are available on the ATO website Instant Asset Write off The instant asset write off for income tax purposes has been extended to 30th June 2020 and now includes businesses up to $50 million turnover. The threshold that can be claimed is: All business up to $50 million turnover:

2 Comments

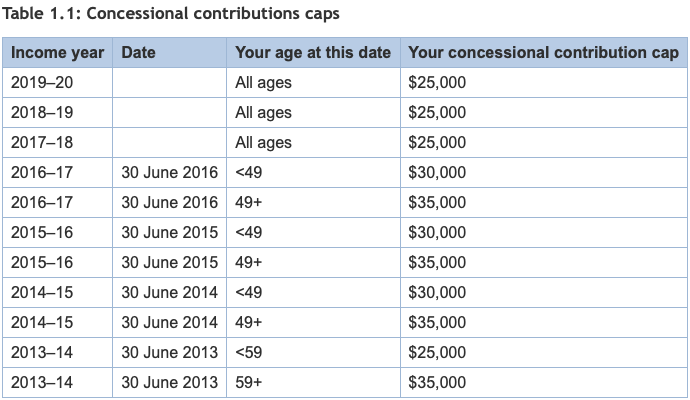

There are caps on the amount you can contribute to your super each financial year to be taxed at lower rates. If you contribute over these caps, you may have to pay extra tax. The cap amount and how much extra tax you have to pay may depend on your age, which financial year your contributions relate to, and whether the contributions are:

Concessional contributions cap Concessional contributions include:

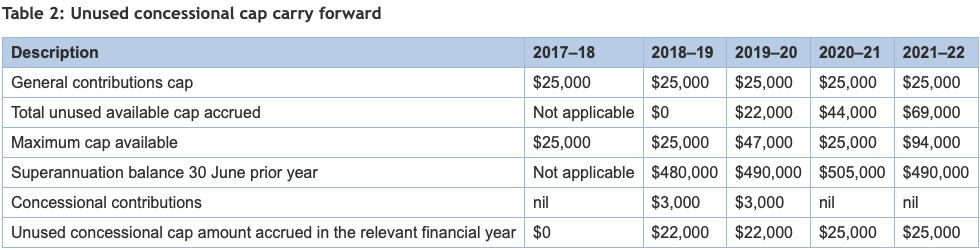

Excess concessional contributions from 2013–14 onwards are included as taxable income, taxed at the marginal tax rate plus an excess concessional contributions charge. For 2012–13 and earlier years, excess concessional contributions were taxed at 46.5% (15% levied in the super fund, with an additional 31.5% payable). Unused concessional cap carry forward From 1 July 2018 if you have a total superannuation balance of less than $500,000 on 30 June of the previous financial year, you may be entitled to contribute more than the general concessional contributions cap and make additional concessional contributions for any unused amounts. The first year you will be entitled to carry forward unused amounts is the 2019–20 financial year. Unused amounts are available for a maximum of five years, and after this period will expire. Note: This Table assumes no indexing of general cap.

General concessional contributions cap From 1 July 2017 the general concessional contributions cap is $25,000 and is indexed in line with average weekly ordinary time earnings (AWOTE), in increments of $2,500 (rounded down). From the 2017–18 financial year, the general concessional contributions cap is not calculated based on age. The thresholds currently sit at $25,000 for all age levels, but it important to remember that the current threshold have only been in place in recent times. Please also remember to review your unused concessional cap carry forward thresholds. |

Archives

February 2023

Categories

All

|

RSS Feed

RSS Feed