|

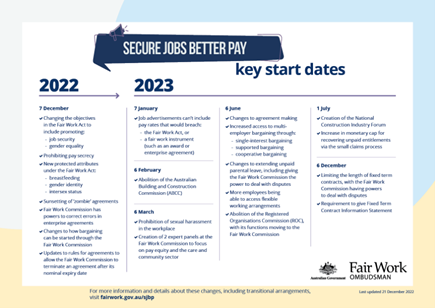

On the 6th of December 2022, the Fair Work Legislation Amendment (Secure Jobs, Better Pay) Act 2022 (Cth) (Act) received Royal Assent and became law. Some of the changes have already come into effect, whilst others will be rolled out over the next 12 months. Employers should start planning and preparing for the impact of these significant reforms.

See below a summary of some of the legislation changes to be implemented in 2023. Prohibiting Pay Secrecy – Commencement Date 7th December 2022 The Act introduces a workplace right for employees to disclose (or not disclose) information about their remuneration and ask any other employee (whether employed by the same or a different employer) about their remuneration. The Act invalidates any existing pay secrecy terms in contracts of employment. Given that it is a workplace right, employees will be protected from being adversely treated concerning their exercise of this right. For example, an employer could not now dismiss someone for discussing their pay with a colleague. This workplace right is partly intended to address the use of pay secrecy to conceal gender pay gaps, which means employees are now free, if they choose, to discuss their pay with others without fear of adverse action from their employer. What Does This Mean for Employers? This change means employers can no longer include pay secrecy clauses in a worker’s employment contract, and no employment agreement should have pay secrecy clauses. This prohibition is enforceable by the Fair Work Ombudsman (FWO), which has the power to initiate court proceedings for any alleged breaches of this new prohibition, which could result in penalties to the employer. Job Ads – Commencement Date 7th January 2023 The new laws also include prohibiting job ads with pay rates lower than the legal minimum entitlements that apply to the job. The act also amends the Fair Work Act to prohibit employers from advertising employment at a rate of pay that would contravene the Fair Work Act or a fair work instrument. Before advertising for a position, businesses should ensure that the rate of pay and other workplace conditions offered comply with the Fair Work Act or other fair work instruments, including Modern Awards and Enterprise Agreements. These requirements apply from 7th January 2023, regardless of when the ad was initially posted. Flexible Work – Commencement Date 6th June 2023 Under the Fair Work Act, employees can request flexible working arrangements in certain circumstances (such as where they are a carer or have a disability). The personal circumstances giving rise to a right to request such an arrangement have been expanded to include employees who are pregnant or where they have experienced family and domestic violence. An employer can now only refuse such a request where the request has been discussed with the employee, and the employer has genuinely tried to reach an agreement. If the refusal is on reasonable business grounds and the employer has provided the employee with detailed reasons for the refusal in writing. If an employer and the employee have discussed the request and agreed to make changes to the employee’s working arrangements that are different to what the employee requested, the employer needs to confirm these agreed changes in writing within 21 days of the request. We may see more orders to increase wages in low-paid industries with high proportions of female workers, e.g. aged care, childcare, health, etc. Fixed Terms Contracts – Commencement Date 6th December 2023 (unless the Australian Government sets an earlier date) One of the fundamental changes arising from the Fair Work Legislation Amendment (Secure Jobs, Better Pay) Act 2022 relates to changes to fixed-term and outer-limit (also known as maximum-term) contracts. Almost one in three workers in Australia are in insecure work arrangements, which limit their ability to bargain for better wages and security. A fixed-term contract is where employment is offered to a person for a specific period. An outer-limit contract is where a contract has an end date, but the employer has the right to terminate the contract before that date. From the 6th of December 2023, employers will have to give employees they’re engaging on new fixed term contracts a Fixed Term Contract Information Statement. This statement will be available on the Fair Work Ombudsman website before then. The Act prohibits using fixed term contracts for a period greater than 2 years (including renewals). In addition, fixed term contracts cannot be extended more than once. An employer must also provide an employee who will be engaged on a fixed term basis with a copy of the Fixed Term Contract Information Statement (which the Fair Work Ombudsman has been tasked to prepare). Gender Equality The Gender Pay Gap in Australia has refused to close and has recently gotten worse, with women earning $472 less than men on average. Workplaces with collective bargaining can deliver higher wages for women. This Bill will make it easier to bargain, including by allowing bargaining over measures to reduce the pay gap for the first time and allowing women to negotiate across workplaces, particularly in industries where their work has been undervalued. The Bill will also strengthen the equal pay laws in the Fair Work Act by:

Respect at Work Bill The Respect at Work legislation introduces two critical changes to the law. Positive duty to eliminate sexual harassment and discrimination The new legislation places a positive responsibility on employers to implement measures to eliminate, as far as possible, sex discrimination and sexual harassment. This duty will not be enforceable until 12 months after the Bill receives “royal assent” (i.e. the date the Bill achieves final approval – likely to be in the next few days – so not before December 2023). The significance of this change is that whereas the law currently “bites” when there is an incident of sexual harassment in the workplace (and holds employers liable if it is found that they did not do all they reasonably could to prevent it from occurring), under these new duties, an employer will have breached their responsibility (and can be subject to financial penalties) even if no sexual harassment has occurred. Regulators will be able to assess whether the employer is currently taking active steps to eliminate any potential sexual harassment and discrimination in the workforce, even before an incident has occurred. Source: Employment Innovations: Huge Changes to Employment Law on the Way Sexual Harassment From 6th March 2023, the Fair Work Act will prohibit sexual harassment in connection with work, which includes in the workplace. The protection won’t apply to sexual harassment of a worker that starts before 6th March 2023. Employers will now be liable for sexual harassment in their workplaces which non-employee workers and contractors perpetrate. Employers will be liable for sexual harassment which occurs in their workplaces unless they can demonstrate they took “all reasonable steps” to prevent it. The FWC will now have the power to order compensation to be payable to victims of sexual harassment. These changes will take effect in March 2023. Employment Innovations will have materials and resources to assist with these matters available shortly.

0 Comments

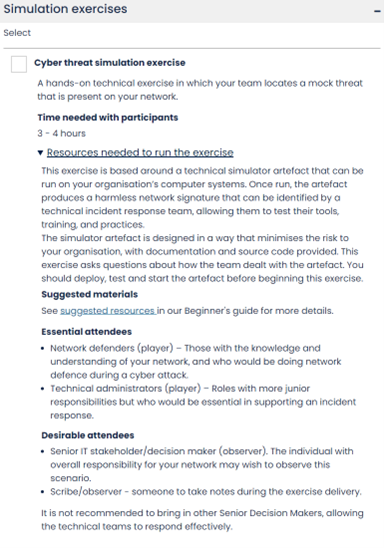

Be Business Ready for a Cyber Incident In its annual cyber threat report, ACSC assessed that medium sized businesses had the highest average loss per cybercrime where a financial loss occurred. The rise in the average cost per cyber incident is more than $39,000 for small businesses, $88,000 for medium businesses and $62,000 for large business. Source: ACSC Annual Cyber Threat Report, July 2021 to June 2022 Australian Cyber Security Centre (ACSC) has launched a free online tool to help prepare small and medium enterprises (SMEs) in the event of a cyber incident. Exercise in a Box guides users through cyber security exercises and includes everything you need to plan, set up and deliver the exercises to your organisation. It also includes a post activity report function that allows you to capture any findings you make during the exercise and use these findings to make meaningful changes to your cyber security posture. Exercises start by introducing an event, which could be for example an organisation’s IT being attacked, these events are referred to as ‘injects’. Subsequently, the exercise continues by asking a set of questions relating to the ‘inject’. Exercise in a Box does not require users to enter a simple answer to these questions; they are intentionally worded in order to solicit discussion. One will often find there is no simple answer. The online tool will keep evolving to ensure it stays current, relevant, and engaging. Discussion Based Exercises

Think about what aspects of cyber threat management you would like to explore. These exercises help identify cyber security practices that can be employed at a low cost and provide a solid foundation for cyber security management.

A simulation exercise mimicking a cyber threat present on an organisation’s network. |

Archives

February 2023

Categories

All

|

RSS Feed

RSS Feed